The licenses of Moniepoint, Opay, and other fintech banks operating in Nigeria have not been canceled, according to Olayemi Cardoso, the governor of the Central Bank of Nigeria.

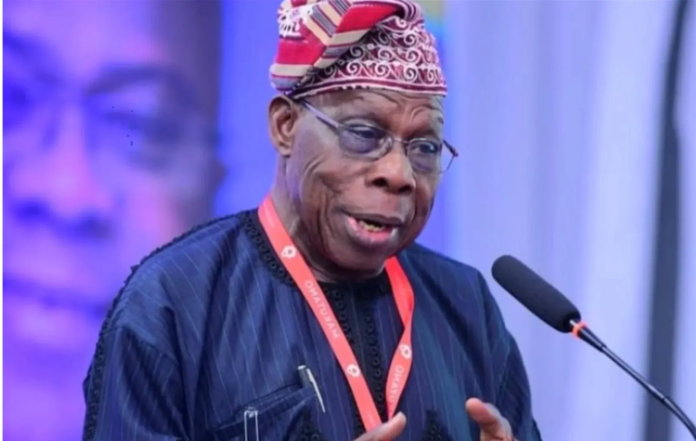

In a statement following the Monetary Policy Committee meeting in Abuja on Tuesday, Cardoso revealed this.

The CBN is not opposed to fintechs, he said.

Read Also: CBN lifts interest rates to 26.25%, breaking news

His response follows the bank’s prohibition on OPay, Palmpay, Kuda Bank, and Moniepoint onboarding new clients for several weeks due to claims that their accounts were being used for unauthorized foreign currency transactions.

Cardoso emphasized that in order to prevent leaks, the CBN must tighten its banking laws.

Fintechs are neither opposed by CBN, nor has it revoked the license of any fintech business. Still, he emphasized that tighter regulations in the industry are required to prevent leaks, he stated.

‘The situation is our constitutional duty for guaranteeing ensuring the banking system keeps being sound, comfortable, and fit for its intended use,’ the speaker went on.

According to VIZTADAILY, in an effort to combat inflation, which shot up to 33.69 percent in April, the CBN increased interest rates from 24.75 percent in March to 26.25 percent in April.